RunYoung is the only Chinese VC fund listed on the list of the most active VCs in Israel in 2020

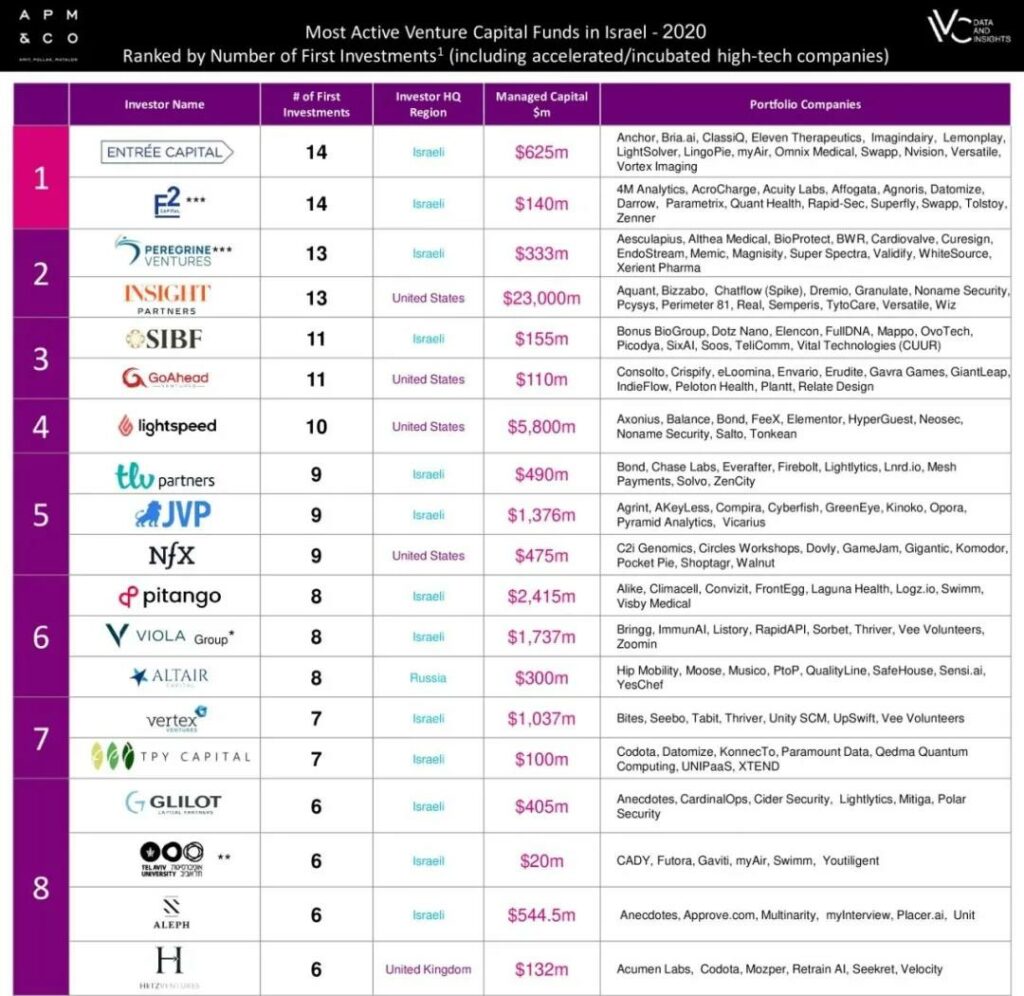

On March 22nd, the latest ” Report on the Most Active Venture Capital Funds in Israel 2020″ was released. RunYoung Investment was honored to be on the list. The report ranks Israeli and foreign venture capital funds based on the number of first-time investment deals (the first time a venture capital fund added a company to its portfolio) in Israeli high-tech companies in the past year. With five successful investments in Israeli startups in a single year, RunYoung Investment tied for ninth place on the list and was the only Chinese venture capital fund listed.

The annual publication: “Report on Israel’s Most Active Venture Capital Funds” is co-produced by the IVC Research Center (Israel’s leading online data provider of data and analysis on Israel’s high-tech, venture capital and private equity industries) and APM & Co (one of Israel’s most prominent law firms in the high-tech venture capital sector). First launched in 2012, the report is based on the number of first-time investments in Israeli high-tech companies by global venture capital funds. It provides an annual research, rating and ranking of the most active venture capital funds as well as trend insights. It is the most authoritative annual report in the field.

The latest edition of the 2020 Annual Report summarizes three major trends in venture capital investments directed at Israeli high-tech companies:

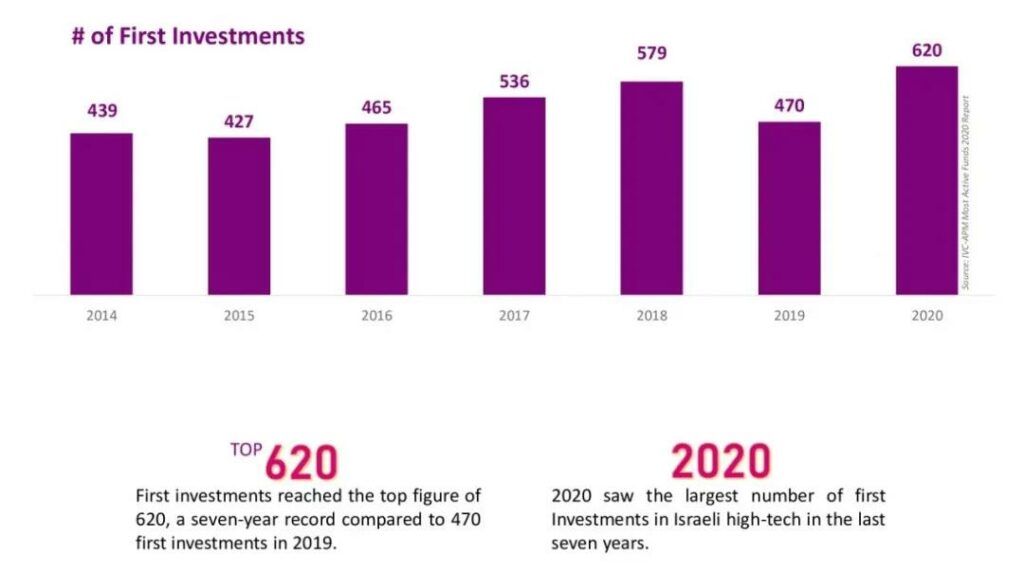

- The COVID-19 epidemic has accelerated the activity of capital investments in Israeli high-tech companies. Even in the face of the challenges of the COVID-19 pandemic, global venture capital funds added 620 new high-tech companies from Israel to their portfolios in 2020. This is the highest level in nearly seven years and is up from 579 in 2018 (second highest ever) and 536 in 2017 (third highest ever), according to the report. This growth reflects the enthusiasm of investors betting on high-tech projects in the healthcare industry and its derivative segments amidst the COVID-19 epidemic.

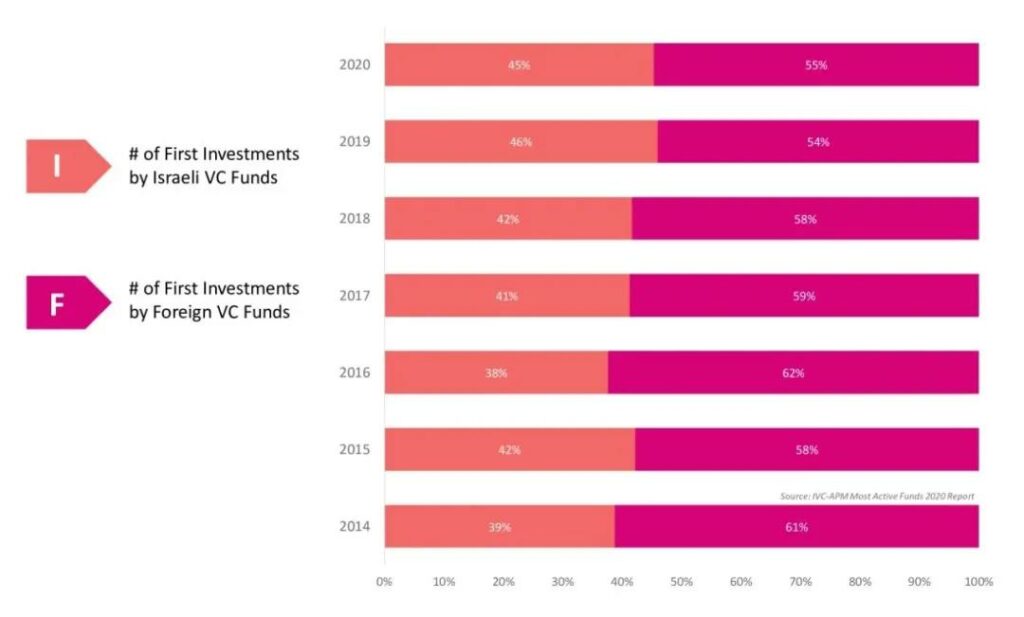

- Israeli technology companies have continued to be closely watched and competed for by foreign VCs in recent years. According to the findings of the IVC Research Center, of the 620 first-time investments directed to Israeli high-tech companies in 2020, 281 came from Israeli-based VCs and another 339 investments (55%) came from foreign VC funds, with an average of 1.6 companies per foreign VC fund. The report shows that the proportion of investments from foreign VCs has remained stable at around 60% since 2014, fully demonstrating the attractiveness of Israeli technology companies and the competition for outstanding Israeli startups by foreign capital.

- There is a growing enthusiasm for capital investment in mid-to-late-stage Israeli high-tech projects. According to IVC, the majority of first investments in 2020 (65%) are in early-stage investments (seed and Series A), with another 25% in mid-stage financing and 10% in late-stage financing. In contrast, capital investment in the next round (mid- and late-stage) of projects is on the rise. The data shows that the number of first-time investments in late-stage projects has grown by about 119% since 2014, representing 10% of total initial investments in 2020. Marianna Shapira, Research Manager at IVC, said, “The number of Israeli venture capital funds will grow in 2020. At the same time, we are seeing the emergence of new types of investment capital, such as growth funds and academic funds, which are meeting the various needs of startups.” In fact, in this report, RunYoung Investment is listed as a representative of an “academic fund” because most of its investments are in early-stage academic research projects in Israel.